Our hourly paycheck calculator accurately estimates net pay (sometimes called take-home pay or home pay) for hourly employees after withholding taxes and deductions. To try it out, just enter the employee details and select the hourly pay rate option. Then, enter the number of hours worked, and the gross pay hourly rate. Looking to pay your employees, quickly and accurately? Intuit’s free paycheck calculator makes it a cinch to calculate paychecks for both your hourly and salary employees. Enter your employee’s pay information and we'll do the rest. We make sure the calculations are accurate by using the most up-to-date tax table.

Free Payroll Calculator Online

Recently started a business and looking for info on how to pay your employees accurately? You’ve come to the right place. Our free paycheck calculator makes it easy for you to calculate paychecks for all of your workers, including employees you pay hourly wages, and your employees who are earning a salary.It’s a cinch to get started—just enter your employee’s pay information and we’ll do the rest for you instantly. We crunch the numbers and give you a rundown of the paycheck amount as well as how much to deduct for things like social security, tax withholding (including federal income tax and local taxes), and voluntary deductions, too.

Free Online Hourly Payroll Calculator California

We use the most up-to-date tax information for local tax and federal withholding to make sure our calculations are accurate. Want to include overtime, bonuses, or commissions? It’s easy to do! Here’s how it works:

Hourly Wage Paycheck Calculator

Need to calculate paychecks for your 1099 workers? Our hourly paycheck calculator accurately estimates net pay (sometimes called take-home pay or home pay) for hourly employees after withholding taxes and deductions.

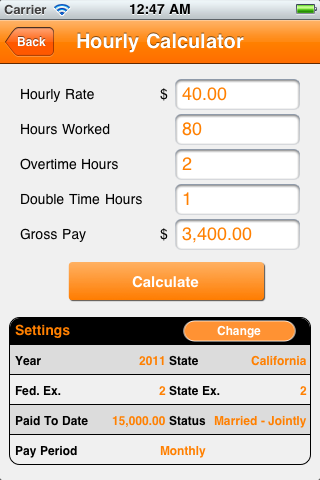

To try it out, just enter the employee details and select the hourly pay rate option. Then, enter the number of hours worked, and the gross pay hourly rate. If you have additional payment info like overtime, bonuses, or commissions to enter, keep going. Be sure to include any federal filing details and additional tax withholdings, if applicable.

When you’ve entered all of the general information, it’s time for some paycheck magic! Calculate the check and then download it to see the correct payment amount and all tax withholdings and deductions. It’s fast, easy, and accurate.

Salary Income Paycheck Calculator

If your employees are paid a set salary, the salary paycheck calculator is the perfect option. Use it to estimate net vs. gross pay for W2 or salaried employees after federal taxes, local taxes. If your employee has requested a voluntary deduction for tax withholding, no problem—you can include that info when using the calculator.

To try it out, just enter the employee details and select the salary pay rate option. Then, enter the employee’s gross salary amount. Need to factor in things like overtime, bonuses, or commissions? That’s easy to do—just enter the amounts in the Additional Pay section of the calculator. You’re almost done, but be sure to include federal filing details and extra tax withholding amounts according to the employee’s payment profile.

When you’re all set, calculate the check and download it to see the correct payment amount and all tax withholdings and deductions for the employee. Once you see how quick the net pay is automatically calculated you’ll be hooked.

Intuit takes the guesswork out of payroll taxes. Ditch the complicated calculations and let us tackle them for you, so you can spend more time and energy on growing your business.